Every trader talks about strategies, setups, and signals — but few talk about what really drives profit: the bid ask spread.

The bid ask spread in options is the invisible line between buyers and sellers, and it quietly decides whether you win or lose before your trade even starts. Think of it as the real game board of the market — one that most traders don’t even see.

Whether you’re buying weeklies or chasing 0DTE momentum, understanding the bid ask spread meaning can save you thousands over time. Because you don’t trade prices.

You trade the space between them.

What Is the Bid and Ask Spread (and Why It’s All That Matters in Options Trading)

Simple Definition (No Jargon, Just Reality)

The bid ask spread is the difference between what buyers want to pay (the bid) and what sellers want to receive (the ask).

In options, this gap can look small — a few cents — but it represents the real trading cost. Every time you hit the market button, you’re paying that difference.

⚡️ In short:

Bid Ask Spread = Ask Price − Bid Price

Why That Difference Is Everything

The bid and ask represent two sides of every trade.

- The bid price is what buyers

- The ask price is what sellers are willing to accept.

The difference between them is the bid ask spread — your real cost to play the game.

It exists in stocks, options, and even forex, and it reflects liquidity: the tighter the spread, the healthier the market.

Formula: Ask − Bid (and Why That Difference Matters)

Bid Ask Spread = Ask Price − Bid Price

That small difference defines your execution.

Buy at the ask and sell at the bid? You lose the spread.

Trade between them? You win efficiency.

That’s why traders use limit orders — to negotiate instead of donate.

Bid and Ask Price Meaning in Real Life

If Apple (AAPL) stock trades at a bid of $170.00 and an ask of $170.05, the bid and ask spread is 5 cents. That means you’ll instantly lose $0.05 per share if you buy at the ask and sell at the bid.

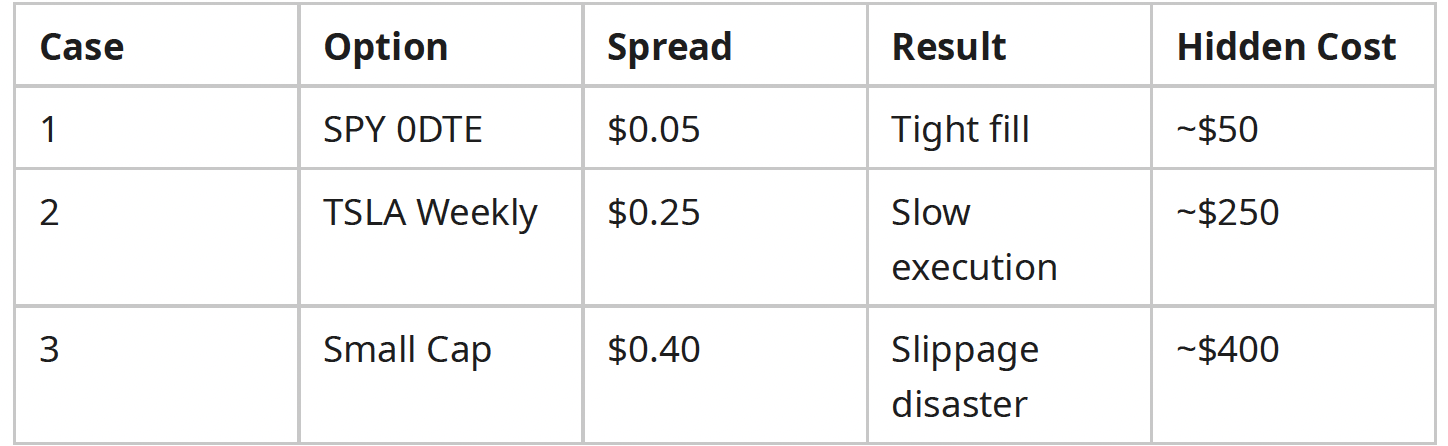

In options trading, that spread can be $0.20, $0.40, or more — turning small moves into big losses if you’re not careful.

Why You Don’t Really Trade Stocks or Options — You Trade the Spread

Every Trade Lives Inside the Spread

Every time you trade, you’re not buying the stock — you’re buying liquidity.

That’s why bid and ask in trading is a universal concept: no liquidity, no fill. Every order you place exists

between the bid and ask size, and that gap is your battlefield.

The Invisible Tax That Eats Your Profits

Zero commissions didn’t make trading free — it just hid the costs. The bid and ask rate acts as a built-in fee that you pay every time you click “Buy.” The wider it is, the more it drains your profit margin.

Example:

You buy 10 contracts of TSLA 0DTE calls at $1.25 ask, with a $1.05 bid.

Sell back at the bid, and you’ve lost $200 — even if the chart didn’t move.

That’s not volatility. That’s spread leakage.

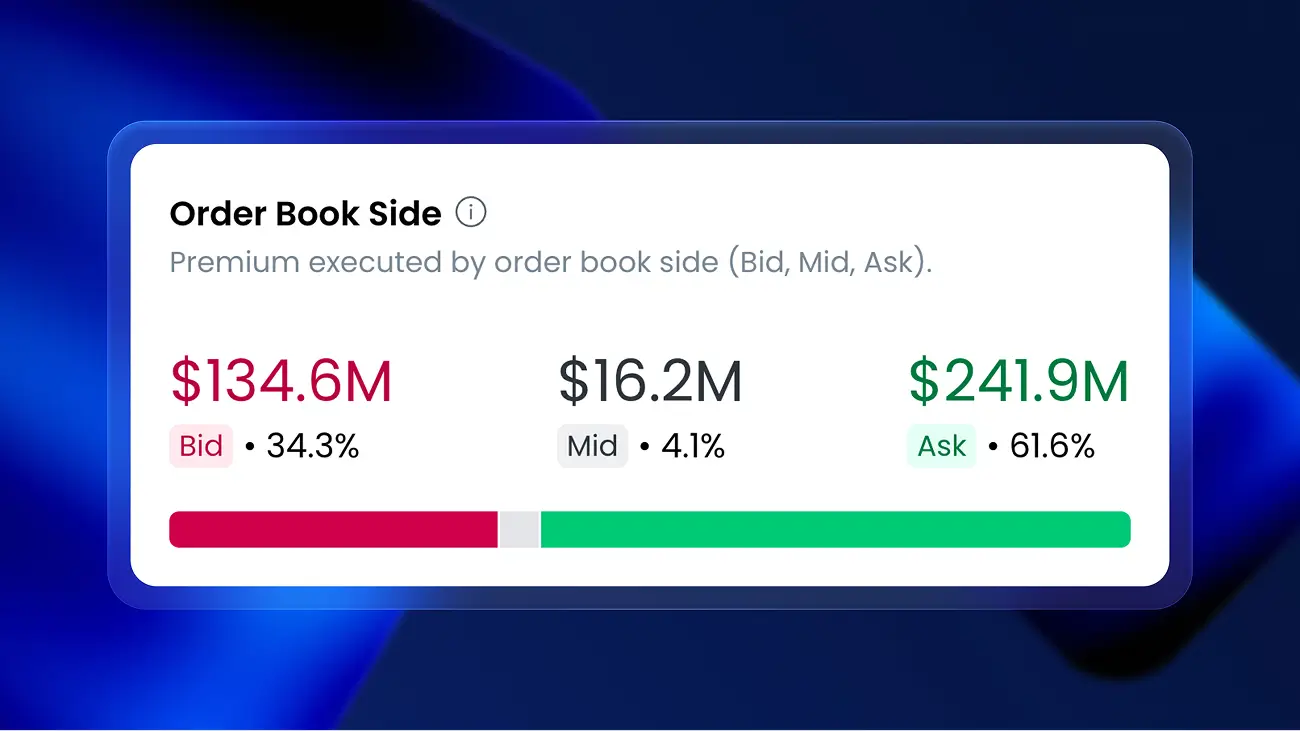

How Market Makers Profit From the Spread

Market makers aren’t predicting the market — they are the market. They manage bid and ask in stock market depth by quoting both sides, buying low and selling high — over and over.

Their profits come from bid and ask size, option chain flow, and volume inefficiencies.

You’re not losing to manipulation; you’re losing to math that’s perfectly legal.

🤫 Retail traders think they’re battling volatility. They’re actually fighting market makers they don’t even see. — MarketSnack

What Drives the Bid-Ask Spread (and How to Read It Like a Pro)

Liquidity and Open Interest — The Tightness Factor

A tight bid ask spread means active trading and competition. Large stocks like NVDA or SPY have spreads as low as $0.01 because there’s high liquidity and constant flow.

Small-cap stocks or thinly traded options? Expect wide spreads — sometimes $0.50 or more.

Tight spreads = efficiency.

Wide spreads = friction and hidden cost.

Volatility and News — When Spreads Explode

Before earnings or breaking news, spreads widen. Why? Because market makers are pricing uncertainty.

It’s not manipulation — it’s protection. In those moments, the bid and ask spread in options can triple.

And if you rush in with market orders, you’re paying premium prices for panic.

After-Hours Trading — The Wild West of Wide Spreads

After 4 PM, the bid and ask in stock market can become unrecognizable. Liquidity vanishes, spreads widen, and execution becomes risky.

If you’re trading then — you’re trading against algorithms, not humans. Avoid entering large positions in illiquid hours.

🧠 Understanding how to read bid ask spread across time frames helps traders spot when liquidity in options signals real opportunity — or hidden traps.

The Psychology Behind Spreads (and Why Most Traders Ignore It)

FOMO + Speed = Costly Fills

Fast fingers cost money. If you chase momentum, you end up crossing the bid ask spread unnecessarily. That’s how market makers profit — they sell to urgency.

Why Execution Beats Prediction Every Time

The direction of the chart means nothing if your entry is bad. The bid and ask mean execution risk. Smart traders know that predicting the next candle is less important than controlling the next fill.

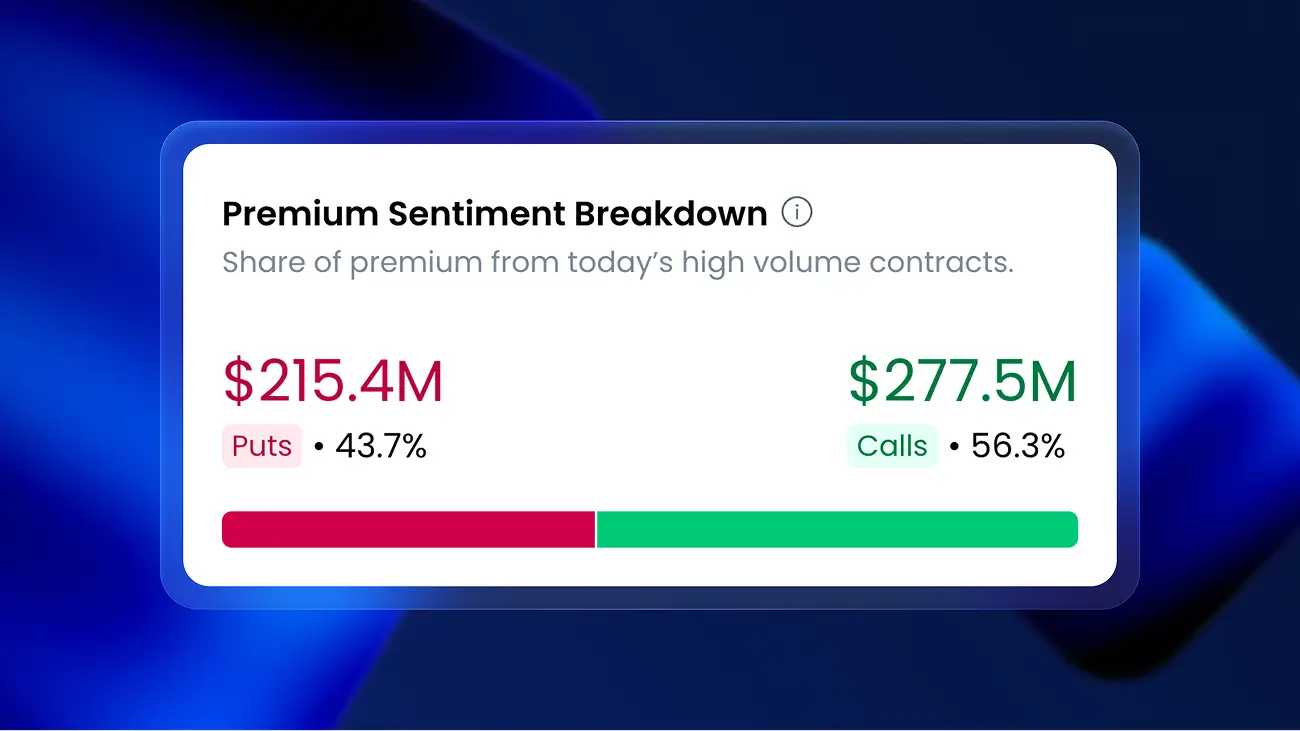

Reading Flow Instead of Reacting to It

The spread tells a story.

When bid and ask size tighten, confidence builds.

When they widen, uncertainty rules.

Charts show the past. Spreads show the now.

😏 You can’t beat the spread if you don’t even know you’re paying it. — MarketSnack

How to Reduce Bid Ask Spread Costs (Without Missing Opportunities)

Limit Orders Are Your Armor

Market orders are emotion. Limit orders are control. By setting your price near the mid, you reduce bid and ask spread costs immediately.

Trade Where Liquidity Lives

Stick to stocks and options with tight bid and ask. If you see a wide spread, that’s not opportunity — that’s a trap.

Avoid Illiquid Hours

Early mornings, late sessions, or pre-market — all have inflated bid and ask rates. The best time to trade is when volume meets volatility.

Follow Real Flow, Not Just Price Action

Charts are lagging indicators. True intent shows up in tape reading trading — watching how orders flow between the bid and ask.

It’s how professional traders detect momentum before it hits the screen.

⚡ Learn how to read bid and ask in trading, control execution, and master the hidden side of the market.

Case Studies — When the Spread Eats Traders Alive

Lesson: The difference between a tight and wide spread is the difference between consistency and chaos.

The Modern Way to Read the Spread (and Stop Losing to It)

Traders Spend Hours Reading Spreads — MarketSnack Does It Instantly

Manual tape reading trading used to be how pros spotted smart money. Now, MarketSnack automates that process — scanning real-time option flow and bid ask activity across the market in seconds.

Real Institutional Flow, Simplified for Retail Traders

MarketSnack detects spikes in bid and ask size, large premium trades, and institutional flow before the move happens.

You see the story as it unfolds — not after.

No More Guessing — Just Flow and Context

Forget chart chasing.

With MarketSnack, you see why spreads tighten, when they expand, and where volume is building. That’s not noise — that’s liquidity intelligence.

Charts are dead. Flow is alive. MarketSnack turns chaos into clarity — showing you how to read bid ask spread like the pros. — MarketSnack

How MarketSnack Solves the Spread Problem

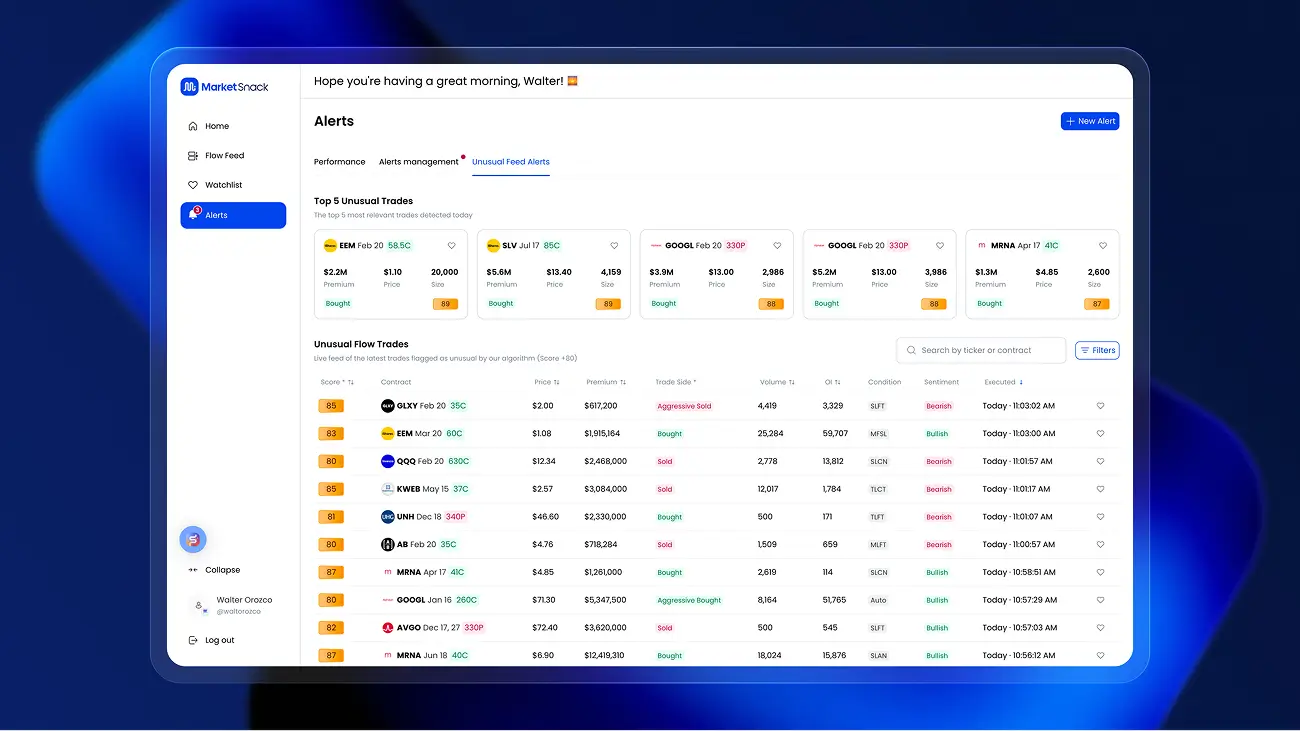

Unusual Feed Alerts — Detect What Others Miss

MarketSnack’s Unusual Feed Alerts flag rare, high-impact trades that distort normal spreads. When institutional money strikes, you’ll see it first.

Alert Tracking — Know What Happens After the Hit

Every alert gets tracked and labeled: Success, Miss, or Still Elevated. You’ll learn which market makers’ activity actually matters — with real data, not noise.

Smart Filters — Focus on What Matters

Filter option flow by context: 0DTE bursts, big delta trades, or aggressive openings. MarketSnack’s Smart Filters isolate the signals that move spreads before prices react.

Watchlist Total Return — Track What’s Working

Your watchlist becomes a performance board. See your total return and liquidity strength across tracked tickers in real time.

Big Delta Trades — Follow the Conviction

Identify trades with high delta, premium size, and directional intent. That’s where conviction lives — and where spreads compress before a move.

😎 How does Marketsnack do it?

MarketSnack doesn’t predict — it interprets.

It helps you read the spread, spot institutional footprints, and act before the crowd.

Final Thoughts — The Spread Is the Market

Every Quote Hides Intent — MarketSnack Reveals It

Every tick, quote, and order reflects intent. MarketSnack makes that visible — transforming the bid ask spread in options into a readable, actionable signal.

From Confusion to Control: Real Data, Real Flow, Real Edge

Stop reacting to candles and start reading flow. With MarketSnack, you finally trade what matters — not what glows green.