You’ve been staring at charts thinking they’ll tell you the truth. They won’t. Markets don’t move because of lines — they move because of data. And the data that matters most lives inside Options Greeks.

Those five letters — Δ, Γ, Θ, ν, ρ — quietly control your P&L.

What Are Options Greeks? (Plain-English Definition)

Quick Definition

Options Greeks measure how an option’s price reacts to changes in key market factors — price, time, volatility, and interest rates.

They’re the nervous system of options pricing sensitivity and the backbone of risk management.

Why They Matter More Than Charts

Charts show what happened. Greeks show what’s about to happen.

Pricing Sensitivity 101: Measuring Risk and Movement

Every option lives inside a mathematical model — and the Greeks are the map. They measure your exposure to each dimension of the market:

- Delta: direction and probability.

- Gamma: acceleration of risk.

- Theta: time decay.

- Vega: volatility impact.

- Rho: rate sensitivity.

Delta — Direction & Probability (Your First Signal)

What Delta Measures

Delta shows how much the price of an option will move if the underlying stock moves $1. It also doubles as a probability proxy: a Delta of 0.60 suggests a 60% chance your option will expire in the money. Delta isn’t just a number — it’s your exposure.

Delta & Hedging

Institutions hedge Delta dynamically by buying or selling the underlying stock to stay neutral. That’s why you see Delta hedging waves move markets — not price levels, but positioning shifts.

Examples: ATM vs ITM vs OTM

- ATM (At-the-Money): Delta ≈ 0.50 → balanced risk/reward.

- ITM (In-the-Money): Delta 0.70–0.90 → moves almost like the stock.

- OTM (Out-of-the-Money): Delta 0.20 → cheap lottery ticket, fast decay.

“Delta is the only opinion that actually matters.” — MarketSnack

Theta — Time Decay (The Silent P&L Killer)

What Theta Measures

Theta tracks how much value an option loses each day as time passes — even if the stock doesn’t move. It’s the cost of waiting.

When Theta Is Your Friend (or Your Enemy)

- If you buy options, Theta is your enemy.

- If you sell options, Theta is your best friend.

Every day, a piece of the premium evaporates — and on weekends, it’s brutal.

Examples: Weekend Decay & Events

Buy an option on Friday before a long weekend? You’ll start Monday poorer, even if the stock’s flat. That’s Theta in action — relentless, quiet, and undefeated.

Vega — Volatility Sensitivity (When IV Rules Everything)

What Vega Measures

Vega shows how much your option’s price changes for each 1% move in implied volatility (IV). When volatility expands, premiums inflate. When it collapses (vol crush), they implode.

Earnings, Macro, and Vol Crush

Before earnings, traders overpay for options expecting a big move. After the event — even if the stock jumps — Vega collapses, and the option loses value. That’s vol crush: the killer of good ideas badly timed.

Example: Same Price, Different IV = Different P&L

A $2 move in price can make money in one week but lose in another, depending on Vega. Timing IV is half the battle.

😉 “The market doesn’t hate your trade. It just hates your timing.” — MarketSnack

Rho — Rates & Carry (The Often-Ignored Greek)

What Rho Measures

Rho measures how sensitive an option’s price is to changes in interest rates. It’s small — until it isn’t.

When It Matters

Rho comes alive in long-dated options or rate-hiking environments. When interest rates rise, call prices generally increase, and puts decrease.

Example: Long Calls vs Long Puts When Rates Rise

In 2022, traders holding long-dated calls saw unexpected boosts — not from stocks, but from rates. That’s Rho’s quiet influence.

😎 “Rho’s boring — until it ruins your trade.” — MarketSnack

How Greeks Work Together (Not in Isolation)

The Stack: Delta-Gamma-Theta-Vega Interplay

Think of the Greeks as an orchestra — Delta leads, Gamma shapes tempo, Theta drains energy, and Vega changes the tune. You can’t trade one without hearing the others.

Scenario Matrix: Trending vs Choppy vs Event Weeks

- Trending market: Delta & Gamma dominate.

- Choppy market: Theta rules — sellers win.

- Earnings/event week: Vega chaos.

Position Risk Map: Long vs Short Premium

- Long premium: You buy time, volatility, and probability.

- Short premium: You sell all three — and pray for boredom.

Greeks in Action — Real Trading Examples

Long Call Before Earnings (Vega Up, Then Vol Crush)

Buy a call pre-earnings → Vega pumps → earnings drop → Vega dies → your P&L cries. Even when you’re right on direction, IV can betray you.

Vertical Spread to Reduce Vega & Theta Risk

Sell another option against your long one. Now Vega and Theta fight each other — a classic risk-balance play.

Protective Put (Negative Delta + Theta Cost)

It’s expensive insurance, but sometimes essential. Your portfolio’s safety net has a price tag — and Theta collects it daily.

Iron Condor (Theta Friend, Vega Enemy)

Sell two spreads around a range. You win if the market chills. You lose if it breathes too hard.

Practical Playbook — How to Use Greeks (Step by Step)

Pre-Trade Checklist

Before hitting “buy,” ask:

- Is the IV high or low?

- What’s my target Delta?

- How much Theta can I tolerate?

- Is liquidity decent?

Sizing by Delta & Managing Gamma

Use Delta exposure to size your position — if your total portfolio Delta = +50, that’s like owning 50 shares of stock. Keep Gamma in check: it makes your Delta move faster than your emotions.

Managing Theta (Profit & Loss Over Time)

Track how much your P&L should decay daily. If the market’s not moving fast enough, exit before Theta eats you alive.

Hedging Fast (When and When Not To)

Delta hedge when volatility’s wild — don’t overreact in calm periods. Gamma will humble over-hedgers.

Common Mistakes (And How to Avoid Them)

Ignoring IV (Vega Surprise)

You can be 100% right on direction and still lose money if you ignore Vega.

Forgetting Gamma Near Expiration

Gamma risk explodes in the final days — it’s not time decay, it’s volatility decay.

Overexposure to Delta Without an Exit Plan

Traders overleveraged on Delta often confuse conviction with gambling.

Underestimating Theta in Long Trades

Holding options for “the long run” is the fastest way to lose in the short term.

Quick Reference — Greeks Cheat Sheet

Table: What It Measures, When It Rules, Pro Tip

Scenario Matrix

Use Greeks to map your risk landscape:

- High IV + Near Expiry → avoid buying.

- Low IV + Trend Week → buy premium.

- Flat Market → sell Theta.

FAQs (People Also Ask)

Which Options Greek Matters Most for Beginners?

Delta. It’s simple, intuitive, and controls direction.

How Do Earnings Affect the Greeks?

Earnings inflate Vega and twist Gamma — both explode before the announcement, then collapse after.

What’s a Good Delta for Swing Trades?

Between 0.40 and 0.60 — enough sensitivity without overexposure.

How Do I Protect from Gamma Risk Near Expiry?

Roll positions early. Never fight a short Gamma trade at the finish line.

How Do I Use Greeks with Spreads vs Singles?

Spreads smooth Vega and Theta — singles magnify them. Choose your pain wisely.

Key Takeaways

5 Quick Rules (One per Greek)

- Delta: Know your directional exposure.

- Gamma: Avoid near-expiry chaos.

- Theta: Respect time — it never stops.

- Vega: Trade volatility, not emotion.

- Rho: Ignore it until rates move — then don’t.

Mini Pre-Trade Checklist

✅ Liquidity

✅ IV context

✅ Greeks awareness

✅ Exit plan

Trade the Flow Behind the Greeks

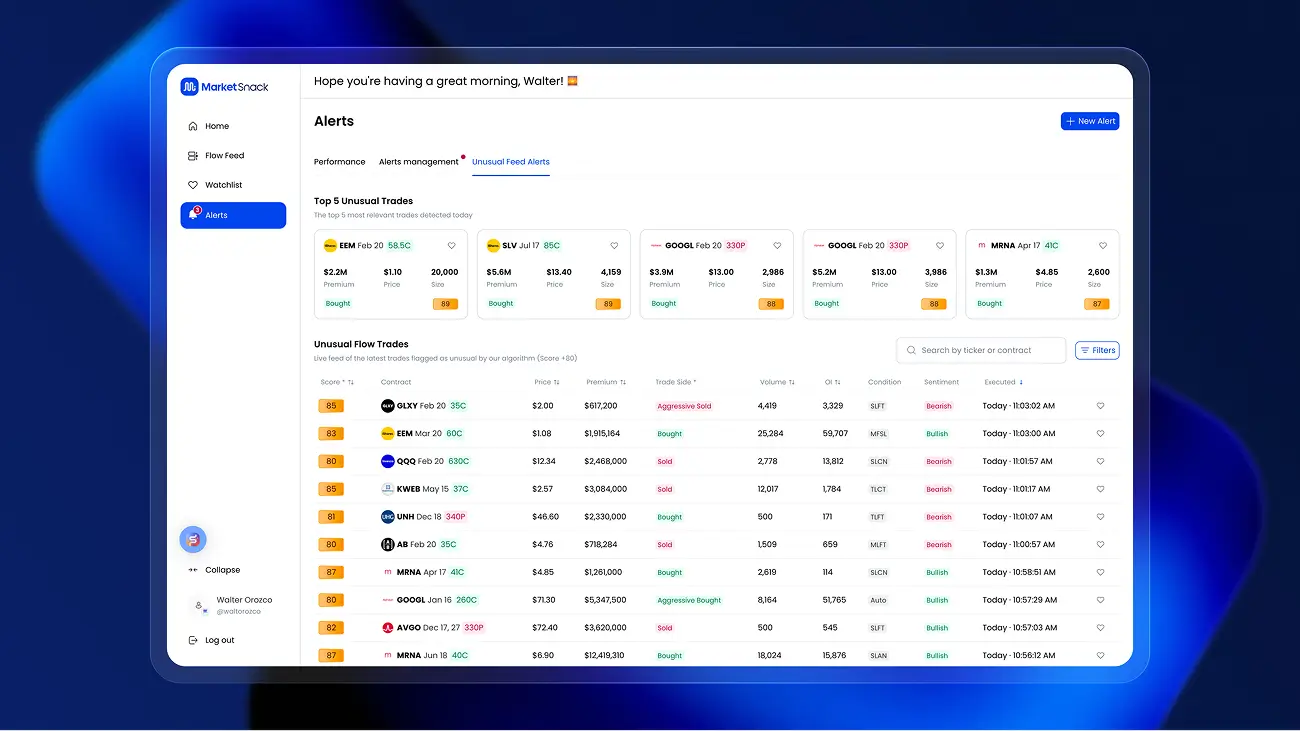

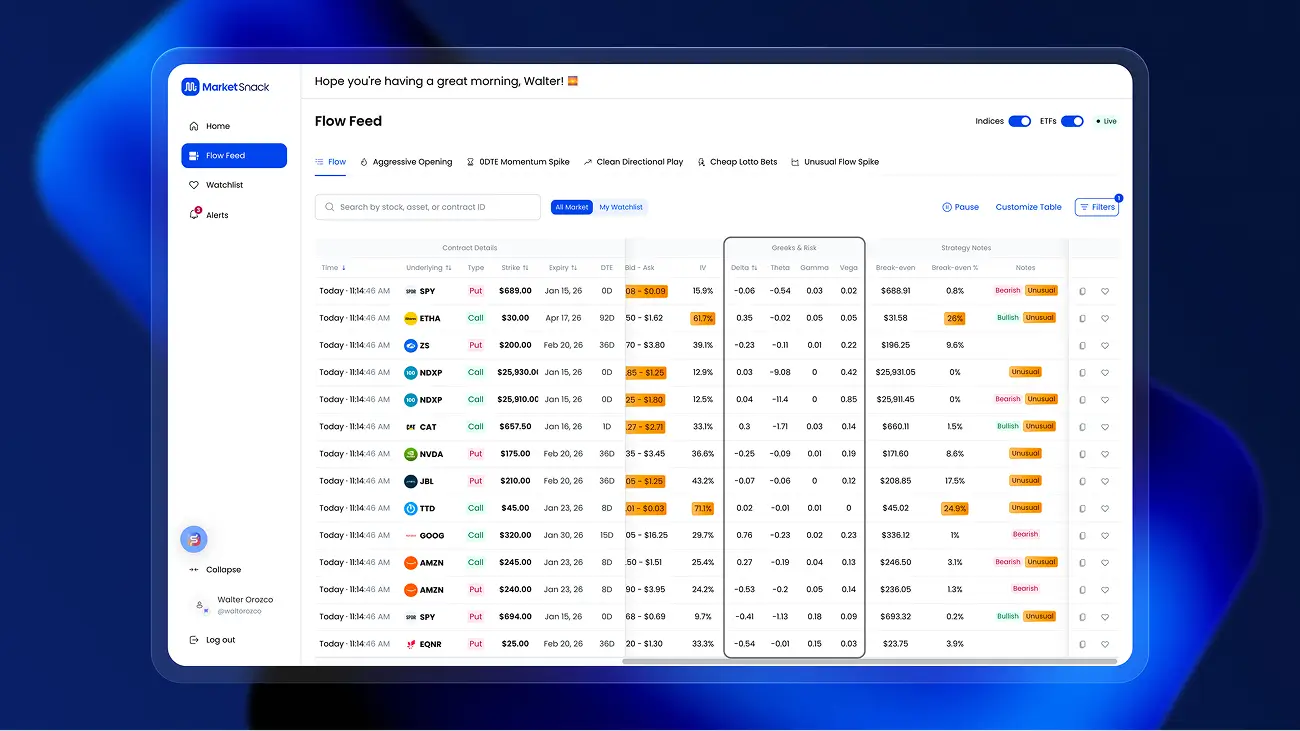

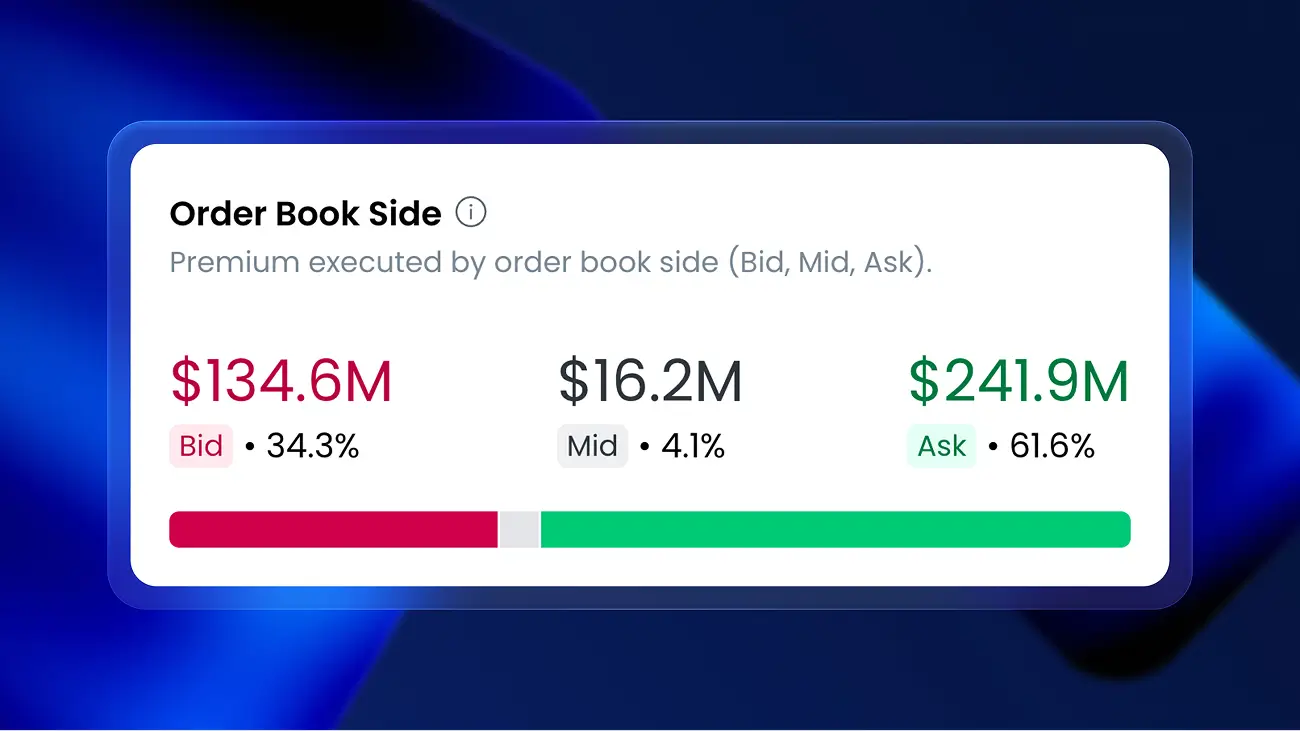

See IV, Delta-Gamma Shifts, and Liquidity in Real Time

MarketSnack gives you crystal-clear Greeks and real-time flow data to understand risk the way pros do.

Detect Where the Real Money Is Moving (Big Delta Trades)

But here’s the real edge: MarketSnack shows you where the big money’s flowing. Our Big Delta Trades feature highlights the contracts with the strongest institutional conviction — where the fattest deltas meet real momentum.

Trade with Insight, Not Intuition

Full transparency. Real data. The juiciest deltas on the street.